Publication

Methane Pyrolysis for Hydrogen Production

This report examines the technology landscape, attributes and advantages, engineering challenges, and commercial status of methane pyrolysis.

The clean hydrogen market is recalibrating. After years of planning, only 11 percent of the world’s planned production capacity for 2030 has advanced to final investment decision. In the United States, major players have pulled back from projects once seen as anchors of the emerging industry. Multi-billion-dollar projects utilizing steam methane reforming with carbon capture (SMR + CCS) in Texas (ExxonMobil), Indiana (BP), and Louisiana (Air Products), and electrolysis projects in New York and California (Air Products) are among those paused or cancelled amid regulatory shifts, economic uncertainty, and weaker-than-expected demand.

This wave of pullbacks underscores a central reality: building a brand-new commodity market rarely advances in a straight line. While turbulence is natural, the urgency of climate change leaves little margin for uncertainty. Recent U.S. efforts aimed at limiting government’s role in regulating pollution are introducing policy volatility at precisely the wrong time.

These difficulties should not be read as a failure of clean hydrogen’s utility. Rather, they offer an opportunity to address major weaknesses: high costs, lack of committed offtake, supply chain and distribution challenges, and even local opposition. This course correction creates space to examine new approaches for a market that, despite challenges, has seen committed investments grow 50 percent year-over-year since 2020.

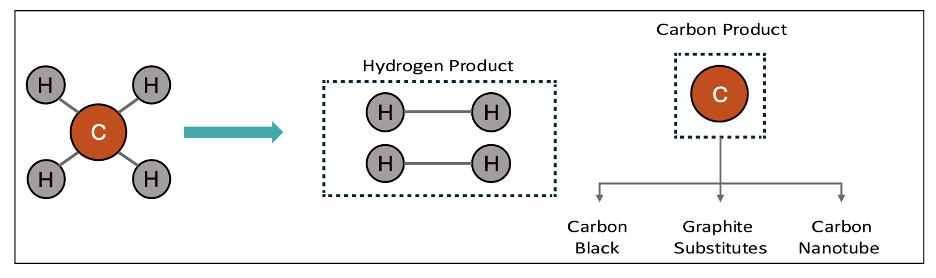

Methane pyrolysis stands out as a compelling complement to other clean hydrogen production methods. Methane pyrolysis uses energy to split methane into hydrogen and solid carbon, avoiding direct carbon dioxide emissions. Crucially, the carbon co-products, ranging from carbon black to graphite substitutes, offer the possibility of a dual-revenue model that could reduce reliance on long-term subsidies.

Methane pyrolysis offers distinct advantages that help overcome several of the shortcomings of today’s early projects. Firstly, production can be co-located with demand. Reactors can be sited where natural gas infrastructure is available; with more than 3 million miles of natural gas pipelines already in place in the United States, hydrogen production with methane pyrolysis offers developers far greater geographic flexibility and substantially lower delivery costs. Additionally, modular reactor designs further reduce cost, adoption, and demand barriers by allowing for a gradual scale-up and testing combined with on-site production. From an environmental perspective, this pathway requires little to no water, easing concerns about the high demand of both SMR and electrolysis production methods in water scarce regions. Finally, it produces solid carbon rather than carbon dioxide requiring underground injection, avoiding the infrastructure demands and other challenges raised with SMR + CCS projects.

The pathway is not without hurdles. The quality and marketability of carbon derived from methane pyrolysis will be decisive in its success. Also, using natural gas as a feedstock requires careful management of fugitive emissions across the value chain and other environmental burdens associated with its extraction. Addressing these challenges only strengthens methane pyrolysis’ position to complement other methods where each is best suited.

Around the world, leading methane pyrolysis companies and researchers are sprinting through different stages of development ranging from lab and pilot scales to first-of-a-kind deployment. While they progress their technologies and products, the United States should be keeping pace with peers like Canada, Germany, and Australia in supporting this advancement.

As policymakers and industry reflect on early market lessons, now is the time to give methane pyrolysis serious consideration.