This “closed-door” session will provide a forum for investors to exchange insights and identify emerging best practices for investor engagement on climate transition planning, a timely and growing priority for investors. The event will feature investor perspectives on key successes, challenges, and opportunities within these engagements, including insights from Andrea Ranger, Director of Shareholder Advocacy at Trillium Asset Management. It will also highlight leading use cases for the newly updated Transition Plan Index tools to deepen engagements and drive impact.

Discussion topics will include:

- Emerging best practices and lessons learned from transition plan engagements

- Common barriers and practical tools for more effective dialogue

- Strategies for utilizing the Real Economy Transition Plan Index during engagements

- How sector-specific considerations shape engagement expectations and withdrawal criteria

- Opportunities for collaboration to strengthen investor asks and incentivize corporate climate action

Additional details on the schedule and speakers will be shared in the coming weeks. Please express your interest through this link and feel free to share it with your network. Attendance will be limited to two registrants per organization. We look forward to seeing you there.

Inquiries: Naila Karamally — karamallyn@c2es.org

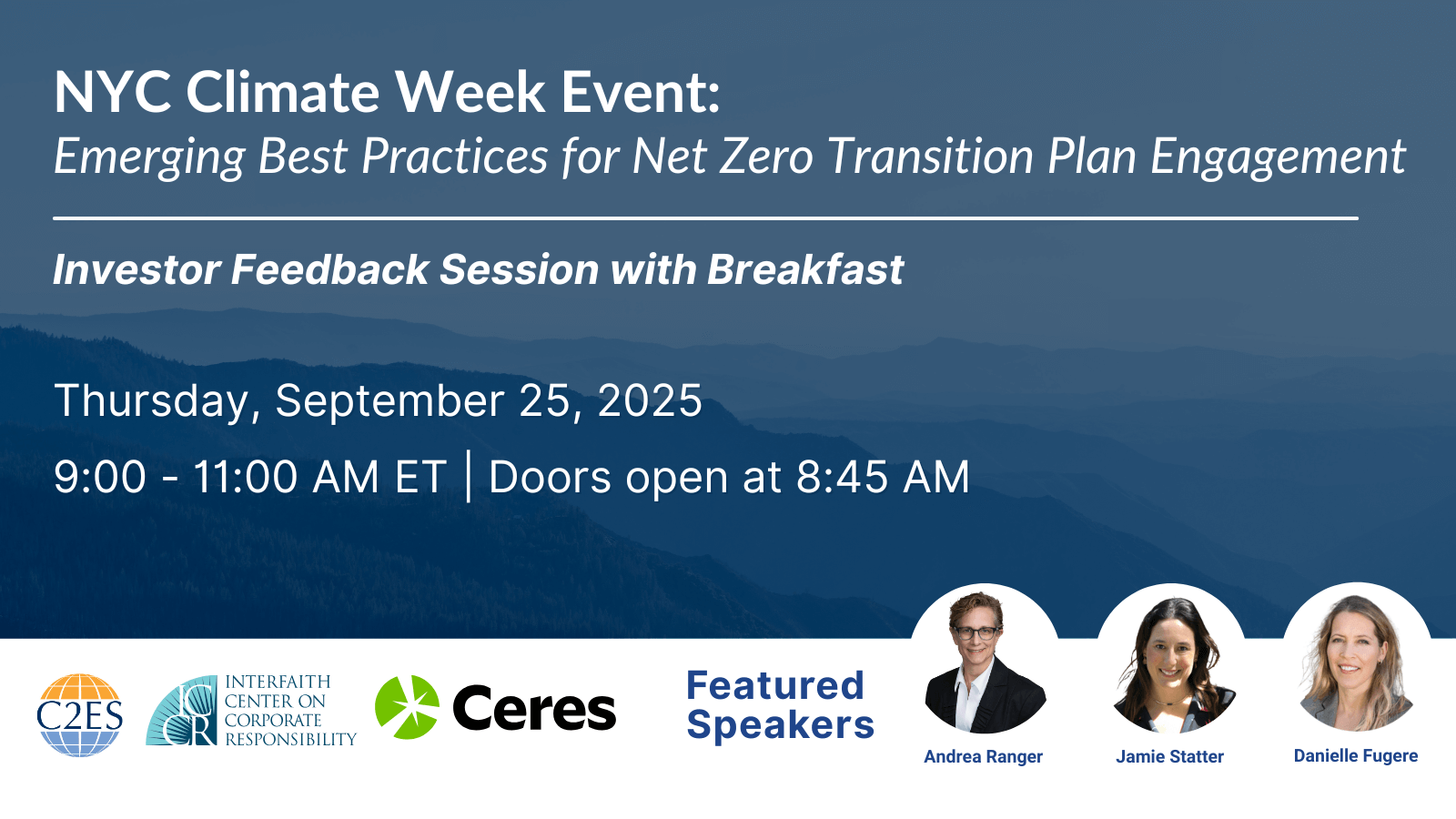

Speakers

Andrea Ranger (Full Bio)

Director of Shareholder Advocacy at Trillium Asset Management

Andrea Ranger is a Director of Shareholder Advocacy at Trillium Asset Management, where she engages Trillium’s portfolio companies on reducing their exposure to climate risk. She focuses on greenhouse gas emissions associated with the expansion of AI and asks portfolio companies to set science-based targets and issue climate transition plans.

Jamie Statter (Full Bio)

Special Advisor, Climate (Asset Management), Office of New York City Comptroller Brad Lander

Jamie Statter is the Senior Advisor for Climate in the Office of Comptroller Brad Lander. Jamie drives the implementation of the New York City Retirement Systems (NYCERS), the Teacher’s Retirement System (TRS), and the Board of Education Retirement System’s (BERS) net-zero by 2040 commitments.

Danielle Fugere (Full Bio)

President and Chief Counsel, As You Sow

Danielle leads As You Sow’s program teams in creating lasting social and environmental change through shareholder advocacy and legal initiatives. She brings an in-depth knowledge of clean energy, sustainability, and team building to her work.