Challenges facing microgrids

Financial and legal hurdles stand in the way of accelerating microgrid deployment.

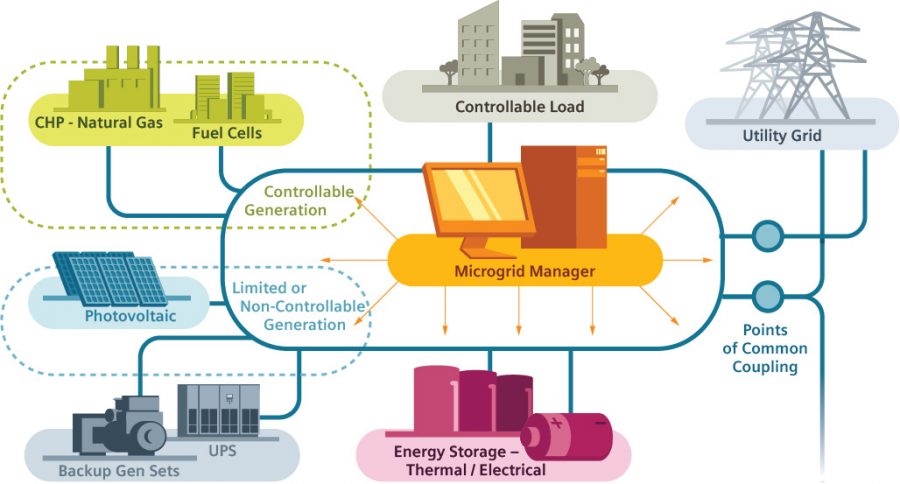

Microgrids tend to integrate multiple energy technologies and unique circumstances into a single project, making them complicated and challenging for investors. Each project can comprise different electric generation types and sizes, serve a unique load, be situated in a unique geography and market, and be subject to unique weather variability and regulations. In addition, while tax credits and preferential tax treatment exist for some of these technologies, they differ by technology, region, and ability of a developer to access. For example, solar and fuel cell technologies are eligible for a federal investment tax credit, but a municipality that does not have a federal tax obligation might not be able to use that credit. With so many variables, each microgrid project may require its own customized financial solution.

Virtually all states lack even a legal definition of a microgrid, and regulatory and legal challenges can differ between and within states. Microgrids face three types of legal hurdles: (1) laws that prohibit or limit specific activities; (2) laws that increase the cost of doing business; and (3) uncertainty, including the risk that new law will be implemented to regulate microgrids and impose restrictions or costs not anticipated at the time of development or construction. Laws also can grant rights and clearly delineate obligations, facilitating development and financing, and making the project more attractive to potential customers.

Fostering microgrid deployment

A number of potential solutions can encourage more microgrid deployment.

- Public-private partnerships can help overcome financial hurdles. Mixed ownership microgrid projects, which can include money from public institutions, utilities, and private entities, have increased from nearly zero in 2013 to a projected 38 percent of the market in 2016. Examples include microgrid partnerships at Peña Station Next in Denver, Colorado, and two government facility microgrids in Montgomery County, Maryland.

- States can facilitate microgrid development. California, Connecticut, Massachusetts, New Jersey, and New York have created clean energy banks, grants, or other funding opportunities for microgrids. For example, New York has established a $40 million grant program to create community microgrid projects. New Jersey created a $200 million resilience bank for the development of distributed energy resources.

- A clearer legal framework is needed to define a microgrid, and set forth the rights and obligations of the microgrid owner. Issues to resolve include the rights and obligations of microgrid owners to their customers and the interconnected utility, cost allocation, and access to wholesale power markets to sell excess electricity or other services.

- Linear programming models can help focus proposed microgrid projects on cost savings, emissions reductions, or independence from the macrogrid. These models can also be used to forecast or estimate cash flows and financing needs and determine strategies for managing power supply and demand, which could be useful during a project’s development and operational phase.