A carbon capture project that could become the world’s largest is bumping up its schedule now that funding from the Inflation Reduction Act (IRA) is flowing, and it is just the start of a wave of new carbon capture and storage (CCS) and carbon dioxide removal (CDR) projects that will help key industries decarbonize and propel the United States toward its target under the Paris Agreement.

Project Bison, in rural Wyoming, is the first major scalable deployment of direct air capture (DAC) technology and the first to inject and permanently store carbon dioxide underground in federally approved wells. The project’s co-developer, Carbon Capture Inc., says it’s on pace to start operations as early as next year. By 2030, the company says it could be removing 5 million tons of carbon dioxide per year from the atmosphere. That’s equivalent to the emissions of more than 1 million gasoline-powered cars per year.

The IRA’s passage in August jump-started deployment plans for several new projects in the carbon capture/removal industry and cleared the way for others. These projects include capturing carbon from a natural gas power plant in West Virginia and clean ammonia production facilities in Iowa, Louisiana, and Texas.

The nation’s largest investment to date in clean energy has changed the economics of removing carbon from the atmosphere, particularly an enhancement and extension (through 2033) of the tax credit companies can claim for sequestering or utilizing carbon, known as the 45Q credit. Additionally, commercial developers of carbon capture projects can now receive direct payment for the full value of the credit each year for five years after CCUS technology has been placed in service; non-profit developers can receive payment over 12 years.

The new law also broadens the scope of projects that qualify for the tax credit and lowers the thresholds for the amount of carbon dioxide captured/removed. The credit is also enhanced for large DAC projects and those that meet prevailing wage and apprenticeship requirements.

The ability to recapture startup costs right away makes new carbon capture and removal projects, especially DAC projects, financially attractive to energy producers and businesses in carbon-intensive industries — like steel, cement, and refineries — that want to reduce their own emissions.

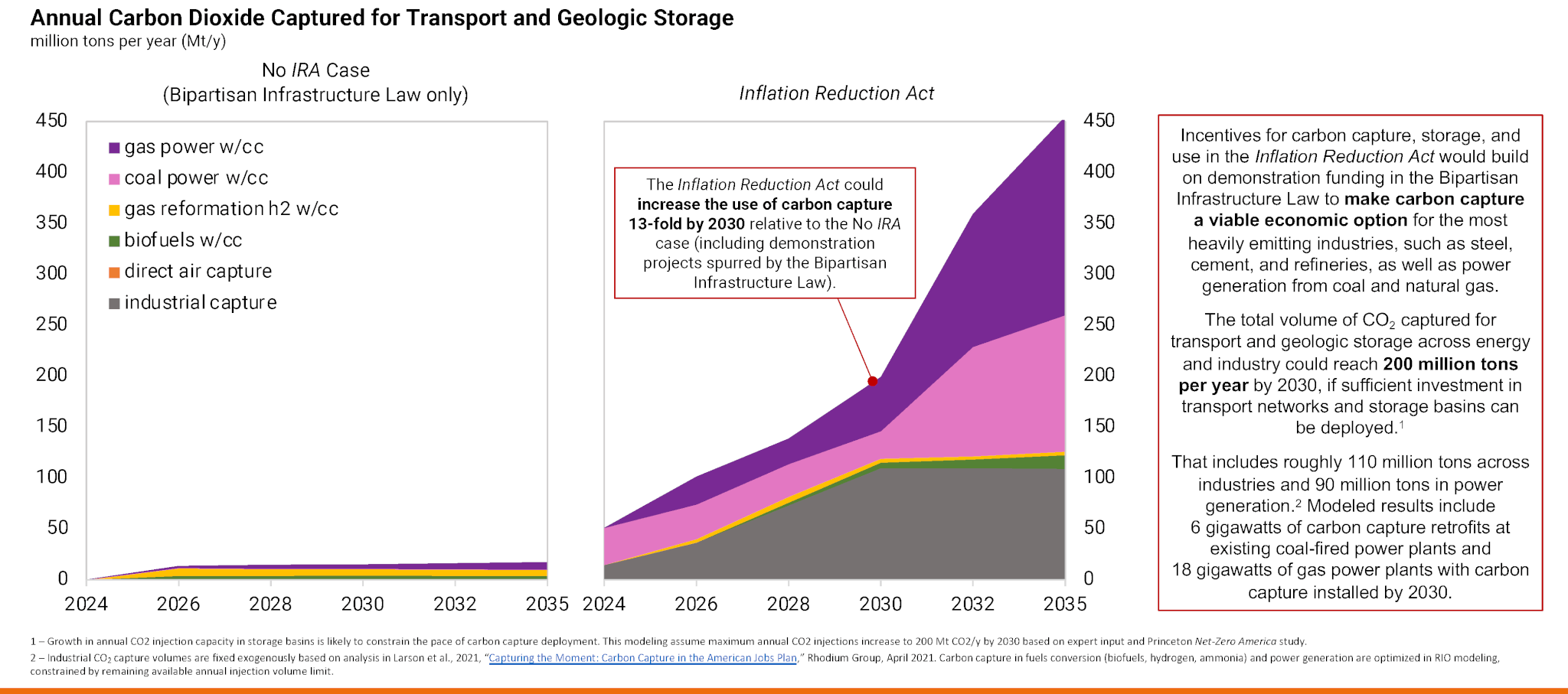

The graph below from Princeton’s REPEAT Project modeled the potential impacts of extending and expanding the 45Q tax credit in IRA. It found that carbon capture provisions account for roughly one-fifth to one-sixth of the total expected emissions reductions, which would increase the total volume of captured carbon dioxide to nearly 200 million tons per year by 2030 – equivalent to more than 25 percent of the total emissions of all coal-fired power plants in the United States in 2020 and represent a 13-fold increase in projects over current policy.