As more nations and companies adopt the goal of net-zero greenhouse gas emissions by midcentury, carbon capture technology has emerged as a critical solution. A recently announced project by Norwegian energy company Equinor to produce zero-emission hydrogen from natural gas with carbon capture and storage technology is a welcome development. Equinor’s plan is also an excellent example of the “hubs and clusters” business model that should increase the attractiveness of carbon capture technology to investors. Another Norwegian project provides a model for the next step in developing carbon capture technology, building out transport and storage infrastructure for captured carbon dioxide to help create a market a market for products made with captured carbon. U.S. state and federal policies that build on current support can enhance the role carbon capture plays as a key tool in decarbonization.

Powering industry using hydrogen and carbon capture

Equinor’s “Hydrogen to Humber (H2H) Saltend” project will provide blue hydrogen for the Humber region, the UK’s largest industrial cluster. The plant is located in the Saltend Chemicals Park, a 370-acre industrial area near Hull City. It produces blue hydrogen by reforming natural gas into hydrogen and carbon dioxide; the carbon dioxide by-product will be captured, transported, and stored in deep geologic formations. The addition of carbon capture makes the hydrogen production process nearly emissions free, when clean electricity is used to power the carbon capture facility.

The H2H Saltend project will help industry across the Humber region decarbonize by switching fuel to a 30 percent hydrogen to natural gas blend, with an anticipated 125,000 tons of hydrogen produced annually. Burning hydrogen creates only heat and water. So, the initial phase of the project is expected to reduce the carbon dioxide emissions in the region by 900,000 tons each year and capture up to 8.25 million tons of carbon dioxide by 2030.

The project is one of many steps toward realizing the 2019 UK law committing to economywide net-zero greenhouse gas emissions by 2050. In their accompanying report, the UK Committee on Climate Change highlighted the role of carbon capture as “a necessity not an option” to meet this target. It also recommended that two industrial clusters should capture at least 10 million tons of carbon dioxide by 2030, and at least one of them should involve substantial production of low-carbon hydrogen.

New markets for captured carbon

Emerging technologies such as hydrogen and carbon capture are necessary to decarbonize industry. Combusting hydrogen can achieve extremely high temperatures (i.e., greater than 2,500 degrees C), which are needed for industrial processes like creating metals, glass, and cement. These levels of heat are difficult to generate physically and economically without burning fossil fuels.

That is why it’s important to encourage investment in carbon capture and other emerging technologies (i.e., low-carbon liquid fuels) like biofuels and synthetic fuels. Advancements in these technologies can provide cost reductions and benefits in other applications and sectors in time to stave off the worst effects of climate change.

Creating markets for products made with captured carbon can also enhance federal support that has taken off since 2016, when the United States acknowledged the role of carbon capture in meeting climate targets in its Second Biennial Report to the UNFCCC. Since then, the 45Q tax credit has been expanded to provide up to $50/ton for carbon dioxide permanently stored in geological formations and $35/ton for carbon dioxide used for enhanced oil recovery (EOR).

Learning economic lessons

Also in that time, the U.S. Department of Energy (DOE) has supported various carbon capture projects, including Petra Nova, the world’s largest post-combustion carbon capture system. Its captured carbon dioxide compressed, dried, and transported to the nearby West Ranch Oil Field in Texas, where it is used for EOR.

Over three years, Petra Nova has captured more than 3.9 million short tons of carbon dioxide. However, a few months after DOE celebrated the facility’s third operating anniversary in January, the project was idled due to the collapse of West Texas crude oil prices early in the COVID-19 pandemic. Nevertheless, this is not a failure for carbon capture technology but an important lesson for the future of the carbon-capture business. Unlike previous projects, Petra Nova was completed on time and on budget. It captured 92.4 percent of the plant’s carbon dioxide (exceeding the target of 90 percent). Also, more than 99 percent of the captured carbon dioxide was sequestered in West Ranch, meeting the DOE target. The project’s problem was that its economics depended on selling carbon dioxide for use in enhanced oil recovery, and the oil market couldn’t support it during a pandemic that brought the economy to a near standstill.

Additional carbon capture markets are needed. That’s why Equinor’s business model of “hubs and clusters” is a compelling strategy; it furthers carbon capture deployment by co-locating hydrogen-production and industrial centers that will use the end products (captured carbon and industrial heat), creating new markets and helping hard-to-decarbonize industries. The H2H Saltend project’s location provides value by integrating the potentials of a decarbonized industrial hub and a hydrogen economy. This kind of “sector coupling” offers a great opportunity to achieve carbon neutrality targets while maintaining economic development. It’s also close to the UK’s most extensive geological carbon dioxide storage in the southern North Sea.

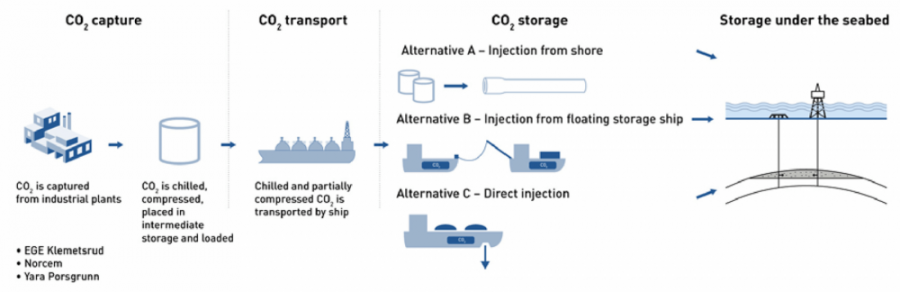

Developing transport and infrastructure

The next step toward building carbon capture technology into a key tool for decarbonizing the economy is to develop carbon dioxide transport and permanent storage infrastructure. This will help create a market for products made from captured carbon and send a clear signal for large capital investments. It also encourages oil and gas companies to diversify and share their experience to enable the energy transition. Norway has been considering this approach and model through another project, developing a full-scale carbon capture value chain in Norway by 2024. This project is considered a central part of Norway’s effort to reduce its carbon footprint and meet the European Union goal of climate-neutrality by 2050.